They depend on others, such as family, a company pension, or the government, to take care of them.In this chapter, Robert Kiyosaki starts off with the 5 things that happen to people who do not invest, or who invest poorly: Learn to overcome fear of rejection and stop worrying about what other people say and think about you.Robert Kiyosaki also lays out 2 essentials to become successful:

In order to get to the B quadrant, you can: Robert passes on what his rich dad told him, which every broke investor should hear, “You may lose 2 or 3 companies before you build a successful one that lasts.” *If operated properly, each system will provide a steady steam of income without much physical effort on the part of the owner once it’s up and running. Network Marketing: Where you buy into & become part of an existing system.Traditional C Corporations: Develop your own system.Robert Kiyosaki explains there are 3 main types of business systems commonly used today: The reality is you already have the perfect position, it’s you. Some go to job to job in search for that “perfect” position. Robert Kiyosaki illustrates the broke motions that we take while pursuing the road to financial freedom.

#CASHFLOW QUADRANT BOOK REVIEW HOW TO#

What was never mentioned was how to build a solid cash flow stream in order to not depend on a J.O.B.Īs said by Jim Rohn, “Wages make you a living. Growing up, The Broke Investor had always been told: “Go to school, get a good job, retire with a 401k and Social Security, etc… In this chapter, we dive into the very fabric that has shaped society to what it is today. The left quadrant will ALWAYS require effort on our part, while the right quadrant, after set-up, will require minimal effort from us.

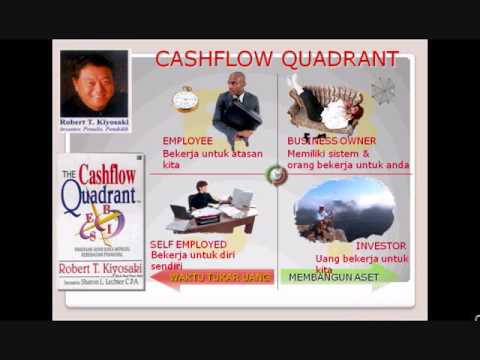

He goes on to give another view of the quadrants:ī = You own a system & people work for you I = Money works for you However, don’t overlook theses quadrants because Kiyosaki states, “You can earn and lose $ in ALL 4 quadrants.” Robert Kiyosaki explains that most people are stuck in the left quadrant & is the MAJOR REASON most can not gain financial freedom. However, Robert Kiyosaki goes on to explain it’s not until 9 years later they reach financial freedom.Į = Employee S = Small Business B = Big Business I = Investor Different quadrants, different people. So instead of doing what every other average person does, Robert & Kim Kiyosaki struggled with homelessness while attempting to build his business/fortune. His rich dad, on the other hand, advised Robert to learn how to make money work for you. His actual father being a highly educated, poor dad, told Robert to work hard in school, get a good job with benefits, etc. Growing up, Robert Kiyosaki had two major influences in his life, his rich dad and his poor dad. Robert Kiyosaki starts off by sharing with you his struggle in the his early days & how he and his wife, Kim, conquer homelessness.

Find out which quadrant you are currently in.Īre you an employee, small business owner, big business owner, or an investor? If you are an employee or small business owner, you are on the left side of Kiyosaki’s CashFlow Quadrant. Kiyosaki.īook #4 to financial independence.

0 kommentar(er)

0 kommentar(er)